Sign Up Today!

The government recently passed a $2.2 Trillion Stimulus Bill to help with the COVID-19 economic relief. While this will undoubtably help our economy immediately, there are likely long-term consequences that may impact your retirement.

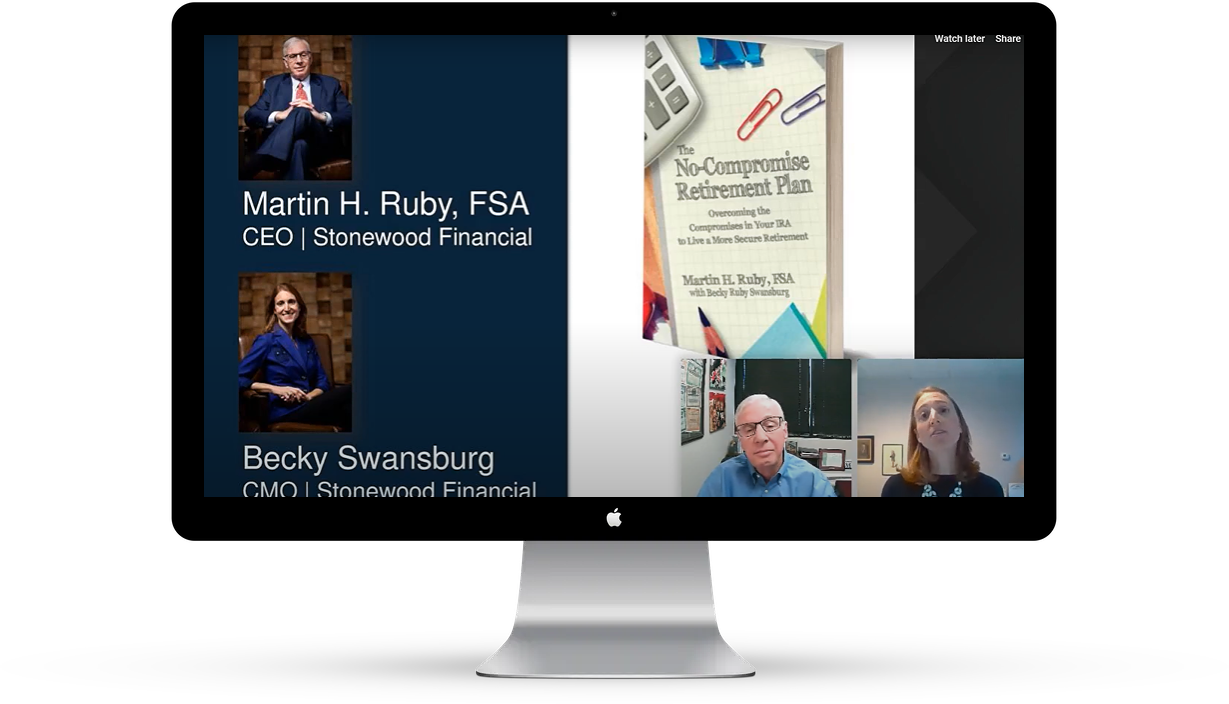

The Wealth Guardians is excited to bring you a presentation by noted financial professionals, Neil Wilding and Becky Swansburg to help explain the potential long-term impacts and some precautions you can take with your retirement.

The Wealth Guardians is excited to bring you a presentation by noted financial professionals, Neil Wilding and Becky Swansburg to help explain the potential long-term impacts and some precautions you can take with your retirement.

Disclosure:

Neither Neil Wilding, Becky Swansburg or Stonewood Financial are affiliated with and do not endorse The Wealth Guardians. The information and opinions presented in this presentation are those of Neil Wilding and Becky Swansburg and do not necessarily reflect the views of The Wealth Guardians.

This presentation is designed to provide general information on the subjects covered. It is not provided to recommend a specific tax plan or arrangement. It is not intended to provide specific tax,

legal or investment advice. This presentation should not be construed as advice designed to meet the particular needs of an individuals situation. Neither The Wealth Guardians, or Neil Wilding/Becky Swansburg may provide tax or legal advice. All individuals are encouraged to seek the guidance of a qualified professional regarding their personal situation. At the conclusion of the presentation you will be offered a consultation with The Wealth Guardians.

This presentation is intended solely for educational purposes and is not an offer or solicitation for the sale or purchase of any security or other financial instrument or to adopt a particular investment strategy. Any charts and graphs included are for illustrative purposes only. All information contained herein is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The views presented today are the views of The Wealth Guardians. Opinions expressed are general in nature, subject to change without notice and are not intended and should not be interpreted as specific investment advice for you or your investments or portfolio. Since individual circumstances vary, you should consult your legal, tax, or financial advisors for specific information. The information presented does not constitute financial, legal or tax advice and should be used for informational purposes only. Any reference to Social Security income and claiming strategies does not necessarily represent the views of the Social Security Administration or Alphastar Capital Management LLC.

Investing involves risk, including the potential loss of principal. Past performance is not a guarantee or predictor of future results of any particular investment, benchmark, or indices, nor a guarantee of achieving overall financial objectives. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions, may materially alter the performance of your portfolio. There are no assurances that a portfolio will match or outperform any particular benchmark. Risk algorithms (“Algorithms”) used in portfolios is NOT A GUARANTEE against loss or declines in the value of a portfolio. While algorithms are designed with the goal of limiting account drawdowns in declining markets, ACM is not able to predict market conditions or ensure that the Algorithm will limit drawdown as designed. Portfolios are subject to a variety of risks, including but not limited to general market risk and risks related to economic conditions. The portfolios’ underlying investments fluctuate in price and may be sold at a price lower than the purchase price resulting in a loss of principal. The underlying investments, unless stated otherwise, are neither FDIC-insured nor guaranteed by the U.S. Government. There may be economic times where all investments are unfavorable and depreciate in value.

Fixed annuities are long-term investment vehicles. Early withdrawal may result in tax liability, penalties and/or surrender charges. These charges may result in a loss of bonus, indexed interest and fixed interest, and a partial loss of your principal. Bonus Annuities may include annuitization requirements, lower capped returns, or other restrictions that are not included in similar annuities that don’t offer a premium bonus feature. Riders are available at an additional cost and are subject to conditions, restrictions and limitations and benefits are generally not available as lump sum payout. Guarantees, if any, are backed by the financial strength and claims-paying ability of the issuing insurance company.

Investment advisory and financial planning services are offered through Alphastar Capital Management LLC (“Alphastar”), a SEC registered investment adviser. The Wealth Guardians and Alphastar are separate and independent entities. The Wealth Guardians offers insurance products through individuals licensed to sell insurance. Comments regarding guaranteed returns or income streams refer only to fixed insurance products offered by The Wealth Guardians and, unless specifically stated, do not refer in any way to securities or investment advisory products offered by Alphastar. Fixed insurance and annuity product guarantees are subject to the claims paying ability of the issuing company and are not offered or guaranteed by Alphastar. The Wealth Guardians and Alphastar are not affiliated in any way with the Social Security Administration.