Download Our Free Retirement Planning Reports

Our Free Financial Reports will help guide you through the decision making process for your Retirement Plan, dealing with Social Security, Tax Planning, and action steps to take with your 401(k).

Tax Survival Toolkit: 5 Critical Tax Strategies Every Retiree Should Know

Taxes are one of the most significant costs associated with retirement planning, but they don’t have to be. If your current retirement plan doesn’t include these 5 critical strategies, you could be throwing away THOUSANDS in higher than necessary tax rates.

Four Critical Social Security Facts

Today, Social Security benefits represent on average a third of retirees’ income. Nearly 90% of Americans 65 and older receive some type of Social Security benefits. About half of married couples and 71% of unmarried people on Social Security rely on the benefits for at least 50% of their incomes. Nearly a quarter of married couples and about 43% of unmarried people rely on Social Security for at least 90% of their income. Here are 4 important facts about Social Security that every retiree should know.

Guide to Maximizing Your Social Security Benefits

As you being to dive deeper into Social Security benefits, it is critical to understand the strategies that may affect you and your family now and in the future. This guide will address each strategy and also prepare you to compile the best plan for you and your family’s future.

Don’t Panic, Volatile Markets

In your investing lifetime, you will live through several periods of market volatility. These periods may cause you to second-guess your investment strategy or even consider a different approach to managing your money. While downturns can be unsettling, it helps to view market activity from a wider perspective.

Fixed Indexed Annuities: Consider the Alternative

An FIA may be an attractive alternative to traditional fixed income options like bonds to accumulate financial assets (tax-deferred) prior to retirement. This report focuses on uncapped Fixed Indexed Annuities which, if structured properly, can help control financial market risk, mitigate longevity risk, and may outperform bonds over time.

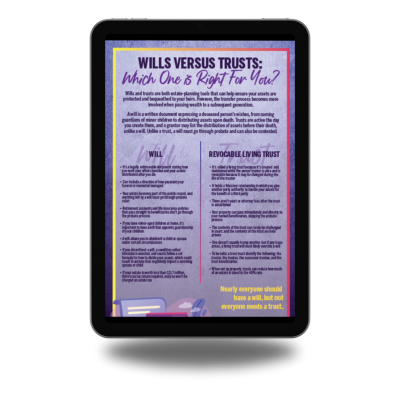

Legacy Planning and Wealth Transfer: Successfully Communicating Your Intentions

The old phrase “communication is key” couldn’t be more accurate when it comes to your wealth transfer and legacy planning process. This guide explores some important questions you might want to consider to help plan your conversation.

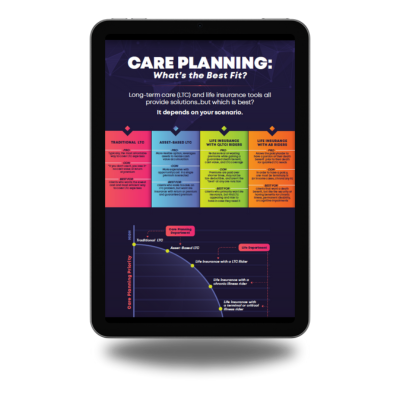

Care Planning: What’s the Best Fit?

When selecting long-term care and life insurance plans, the choices can be almost overwhelming. With so many options, it can be challenging to determine which plan is right for you. Our Care Planning Guide provides a roadmap for deciding what works best for each situation and gives insight into how both LTC and life insurance can be used together or separately to maximize your coverage.

In-Service Withdrawal Flyer

As you continue to save for retirement, you may be looking for additional investment opportunities that offer the potential for security and longevity. An in-service withdrawal provides the opportunity for you to move your retirement investments while still employed with the company.

Sequence of Returns

Timing is critical in just about everything we do, and in retirement it’s no different. In fact, the argument could be made that timing is even more important in retirement. It can either make or break the goals you’ve worked decades to achieve. So how can timing in the markets, or the “sequence of returns” on a portfolio, affect one’s retirement? The answer may surprise you.

What Traditionally Causes Inflation and the Clashing Forces that Will Drive Inflation in 2022

As prices go up, the purchasing power of your income—dollar for dollar—decreases; that is, more dollars are needed to purchase the same amount of goods and services. In time, your personal savings and investments will have to work harder to keep up with or exceed inflation. It is important to consider inflation as you continue to save for retirement and make major purchasing decisions.

Identity Theft: Protecting Your Assets in a High-Tech, High-Risk World

Whether you swipe your card in person, fill out your social security number on a government form, mail a check, or make a purchase online, you’re putting your personal Identification information (PII) out into the world. Aside from going completely off the grid, there’s genuinely no way to avoid it.

5 Things Your Retirement Plan Must Include to Succeed

Most experts agree these 5 components significantly increase the likelihood of a successful retirement plan and can make the difference between just getting by and enjoying the lifestyle you’ve worked your whole life to achieve. Find out what you should be doing so you won’t run out of money before you run out of life!